Covering your Domestic Partner

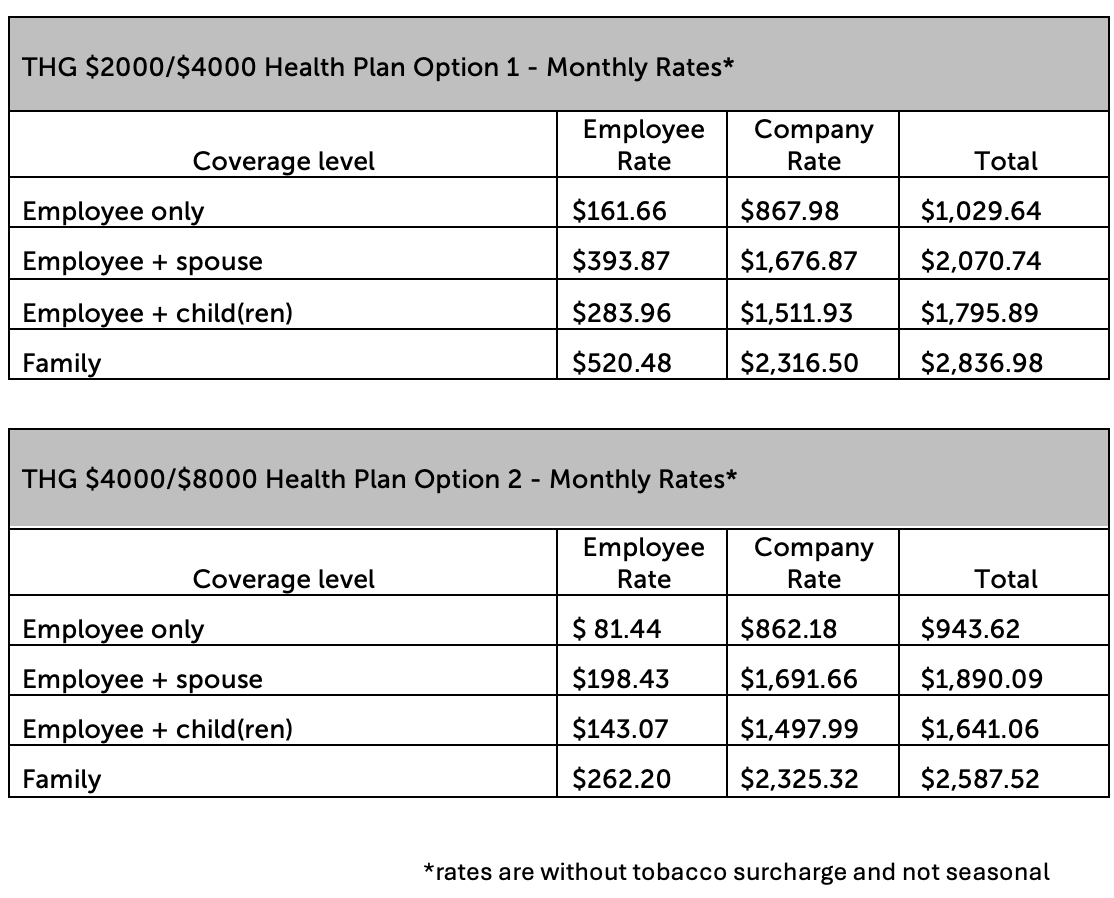

At The Heritage Group, the cost of monthly health care premiums is shared between the Company and you as a plan participant. In general, the Company contributes 86% of this cost each month while you pay just 14%

Overview

Under federal tax law, the portion of monthly premiums that your Heritage employer pays for your coverage (and that of your spouse, child(ren) and certain dependents) is not taxed as income. However, a domestic partner is not considered a spouse under federal law. While premiums for domestic partner coverage are the same as those for covering a spouse or family, there are two income tax implications you should be aware of:

- The portion of the premium you pay that is related to your domestic partner is deducted from your pay on an after-tax basis rather than a pre-tax basis; and,

- The premium amount your Heritage employer contributes to cover your domestic partner and/or your partner’s children is considered taxable income (i.e., imputed income) and is reported as such on your Form W-2.

Both of these will result in additional income taxes being withheld from your pay, so the cost of covering your domestic partner will have the effect of lowering your net income.

If you know your Heritage employer’s share of the cost for covering yourself and yourself plus your domestic partner, as well as your tax rate, you can estimate the tax implications and decide if it makes financial sense to cover your partner for the year. Other factors, including plan features, will affect your decision as well. You may wish to consult a tax professional for personalized assistance

Example (2026 Plan Year)

ASSUMPTIONS:

Plan: $4,000 Health Plan Option 1 (coverage level: Employee + Spouse/Domestic Partner)

Pay frequency: Monthly (12x per year)

Income tax rate: 20%

- Find your and your Heritage employer’s share of the cost per month for covering your domestic partner in the table below:

Calculate the difference YOU PAY in premium that is attributable to your domestic partner, i.e., how much more per month it costs to cover yourself and domestic partner vs. covering just yourself: $393.87-$161.66=$232.21 per month. This amount is deducted from your pay on an after-tax basis rather than a pre-tax basis.

Calculate the difference YOUR HERITAGE EMPLOYER PAYS in premium that is attributable to your domestic partner vs. covering just yourself: $1,676.87-$867.98=$808.89. This amount is considered taxable income (i.e. imputed income) and is reported as such on your Form W-2. Since it’s taxable income, your take-home pay will decrease by the amount of income tax you’ll pay on this amount.

Estimate additional monthly income tax on these amounts, assuming a 20% tax rate ($232.21 x .20 = $46.44) plus ($808.89 x .20 = $161.78)

Calculate annual income tax by multiplying monthly numbers by 12 ($46.44 x 12 = $557.28) and ($161.78 x 12 = $1,941.36) and adding the results together ($557.28 + $1,941.36 = $2,498.64)

Share of Monthly Premiums by Coverage Level (2026 Plan Year)

Resources

Employee Hub

Phone: 1-800-303-0408

Email: [email protected]

How to Enroll Your Domestic Partner in a THG Health Care Plan?

Learn More

Domestic Partner Affidavit Form

Download

Domestic Partnership Termination Form

Download

Need Help? Reach out to Employee Hub

Phone: 1-800-303-0408 | Email: [email protected]

* This portal only summarizes your benefit plans. If there is a discrepancy between the information on the portal and your carrier plan, the carrier plan will always govern.